Introduction

The world of futures trading is rapidly evolving, and automation is no longer just a luxury—it’s a necessity. Today’s traders manage multiple accounts across different brokers, implement intricate trading strategies, and seek to eliminate manual execution risks. But with automation comes new challenges: ensuring reliability, preserving confidentiality, maintaining precise synchronization, and managing risk in real time.

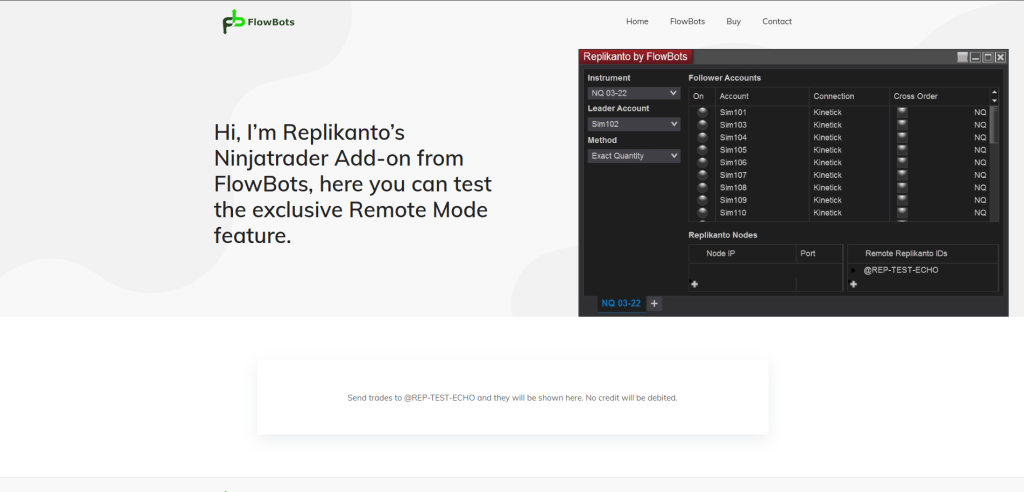

This is where Replikanto, a powerful NinjaTrader add-on, becomes a game-changer. More than just a trade copier, Replikanto is a highly flexible trading automation tool designed for professional traders, prop firm managers, and retail users looking to scale their strategies across accounts.

What truly sets Replikanto apart is its suite of advanced features tailored for modern, automated environments. Whether you need to guard capital with real-time error detection, disguise your strategies with Stealth Mode, run distributed systems through Network and Remote Mode, or replicate complex exit strategies using ATM Copy—Replikanto equips you with the precision and control you need.

In this blog, we’ll take a deep dive into these critical automation features. You’ll learn how to deploy them effectively, avoid common pitfalls, and set up a resilient, intelligent infrastructure using Replikanto in tandem with a high-performance TradingVPS.

What Is Replikanto?

Replikanto is a trade copier (or order replicator) add-on for NinjaTrader 8, developed by FlowBots. It allows a “leader” account to send trades (entries, exits, adjustments) to one or more “follower” accounts based on configurable copy logic.

Some of its notable features include:

- ATM Copy — instead of copying exit orders, it can instruct followers to run their own NinjaTrader ATM strategies for exits, improving speed and flexibility.

- Cross Order — ability to map between contract types (e.g. micro ⇄ mini) for cross‑instrument copying.

- Market Only mode — only copy market executions, skipping non‑market orders to reduce noise.

- Follower Guard — safety rules to automatically disable copy to a follower under certain error or divergence conditions.

- Remote / Network mode — operate across machines (VPSs or computers) over LAN or Internet.

- Stealth Mode — obfuscates the use of copy trading in the order metadata to reduce detection.

Because of these capabilities, Replikanto is widely used in prop firm setups, signal distribution, and multi-account strategies.

Automated Risk Management in Replikanto

One of the most critical considerations when doing multi-account, automated trade replication is risk control. Without safeguards, errors or misalignment in one follower account can cascade into losses. Replikanto offers built-in risk protection via features like Follower Guard, auto‑flatten, and account disarming.

Follower Guard & Auto‑Flatten

If a follower account becomes out of sync—say it has a position when the leader is flat, or an order was rejected—Replikanto can trigger protective actions. It can flatten (close) the follower’s open position and disarm it from further copying until manually rearmed. You can configure thresholds (e.g. timeouts or error counts) for when these protections kick in.

These risk controls are especially important in volatile markets where slippage or partial fills may occur. The guard logic helps prevent orphaned or mismatched trades from building up silently.

Disarm / Rearm Logic & Alerts

When a follower is disarmed due to rule breaches, Replikanto can notify you (e.g. via email) so you can inspect and rearm. This ensures human oversight in critical junctures.

By automating these protections, you reduce the risk footprint of running many synchronized accounts under automated strategies.

Stealth Mode: Hiding the Copier’s Tracks

When you’re copying trades across accounts, you may not always want the broker or third parties to detect that an account is part of a copier setup. That’s where Stealth Mode comes in.

Stealth Mode suppresses the extra metadata that Replikanto normally adds (like linking leader‑follower IDs in order names, OCO tags, etc.). It prevents those markers from appearing in the order history or OCO fields.

However, there’s a trade-off. Because the leader–follower link is held in memory (not recorded in the order metadata), this link can be lost if Replikanto is closed or the machine restarts unexpectedly. In such cases, reconnection may require manual reconfiguration.

Many users enable Stealth Mode in conjunction with Market Only execution (copying only filled market orders) to minimize detection surfaces. That way, fewer traces of the copier logic exist in the order trail.

Use Stealth Mode when needed, but always test thoroughly—especially in live accounts—to ensure you don’t accidentally break copying behavior or lose synchronization.

Network & Remote Mode: Distributed Execution

To scale your copying framework, you often need to run Replikanto not just on one machine but across multiple nodes—some locally, some remote, across different data centers or VPS locations. Replikanto provides Network Mode (for LAN) and Remote Mode (over the Internet) for just that.

In this mode, the leader’s Replikanto instance sends trade instructions across nodes. Follower instances on remote machines receive them and replicate accordingly. Because remote copying uses network paths, you often need credit tokens to authorize cross-machine replication.

Key considerations for network/remote setups:

- Latency & network stability: Remote nodes introduce packet delay, jitter, or occasional dropouts. You must choose VPS locations close to execution servers to minimize lag.

- Credit & bandwidth usage: Data transfer costs and credit usage must be managed so that you don’t run out of credits mid-trade.

- Node monitoring & failover: Monitor node health, reconnect automatically if a node goes offline, and perhaps fail over to alternate paths.

- Firewall & port rules: Remote nodes must have ports open or forwarding configured to allow communication.

When executed well, remote mode gives you flexibility: followers can run on different machines or in distributed geographic locations, yet remain tightly synchronized.

ATM Copy: Smarter Exit Automation

One of Replikanto’s standout features is ATM Copy, which enhances how exit orders (take profits, stops, etc.) are managed. Rather than naively copying leader exit orders across, ATM Copy lets each follower run the leader’s ATM strategy locally.

With ATM Copy enabled, followers receive only the entry order from the leader. The exit orders are generated locally based on the same ATM logic. This has a few major benefits:

- It avoids scenarios where exit orders from the leader cannot be copied cleanly due to contract splits or mismatches in position sizing.

- It maintains coherence: the sum of partial exits in a follower account will always match its open position, avoiding “uncovered” risk.

- It reduces network traffic, since exit logic doesn’t need to travel across the copier link repeatedly.

- It complements more advanced copy modes like Ratio or Pre Allocation, because followers independently handle exit logic in a safe manner.

To use ATM Copy effectively:

- Ensure that the same ATM strategy definitions (names, parameters) exist on follower machines (local or remote).

- Enable ATM Copy for each follower (there’s a column in the follower list where you toggle it).

- Use it especially when your exit logic is complex (multi-step profits, trailing stops) or loads on the network are high.

Even if the leader doesn’t use ATM strategies for some trades, ATM Copy won’t break copying; the system will fall back correctly.

Best Practices & Automation Blueprint

To weave all these advanced features into a reliable system, here are best practices and a sample automation architecture:

- Start with a robust risk framework: enable Follower Guard, set acceptable error thresholds, automatically disarm, and send alerts. Don’t skip safety.

- Use Stealth Mode cautiously: test in demo accounts first, and avoid losing the leader–follower link accidentally.

- For scaling, leverage Network/Remote Mode, but always choose low-latency VPS nodes strategically placed near broker or exchange gateways.

- Use ATM Copy for exit logic so followers generate their own TP/SL orders, reducing dependency on network traffic and minimizing misalignment.

- Monitor latency, node failure, and synchronization continuously. Build dashboards and health alerts.

- Always run test trades (small size) when changing parameters or adding new nodes. Confirm follower behavior matches expectation.

- Periodically rearm follower accounts (if disarmed) after diagnosing root causes.

- Keep your infrastructure (VPS, network, firewall) maintained and redundant to prevent a single point of failure.

By combining risk controls, stealth tactics, distributed architecture, and smart exit logic, you can automate a scalable, resilient copy trading system built on Replikanto.

How to Set Up and Use Replikanto with NinjaTrader

Setting up Replikanto with NinjaTrader 8 is straightforward, but attention to detail is key to ensuring reliable trade replication. Below is a step-by-step walkthrough to help you install, configure, and optimize Replikanto for seamless multi-account and cross-broker trading.

Step 1: Register and Download Replikanto

Begin by visiting the official Replikanto website. After creating your account, download the Replikanto software package, which comes as a NinjaScript add-on compatible with NinjaTrader 8. Be sure to save the file in an accessible location on your computer.

Step 2: Install Replikanto into NinjaTrader 8

Open NinjaTrader 8 and go to the Control Center. From the top menu, click Tools → Import → NinjaScript Add-On, and select the Replikanto file you downloaded. Once the installation completes, restart NinjaTrader to apply the changes and load the add-on successfully.

Step 3: Connect Your Trading Account

Before Replikanto can replicate trades, your trading account must be connected through NinjaTrader. Use the Connections menu to establish a secure link with your broker. Once connected, authorize Replikanto to access and manage your trading activity within the platform.

Step 4: Configure Your Leader and Follower Accounts

Now it’s time to define your Leader account (where you’ll initiate trades) and your Follower accounts (which will mirror the trades). Navigate to Tools → Replikanto Settings. Input the relevant account IDs and choose your preferred replication method — options include Exact Quantity, Ratio-Based, Net Liquidation, and more. This configuration determines how trades are distributed across follower accounts.

Step 5: Run a Test Copy Trade

Before going live, it’s crucial to validate that everything is working as expected. Execute a small test trade on your Leader account and monitor the Follower accounts in real time. Replikanto provides visual tools and logs that help confirm synchronization and spot any errors.

Step 6: Customize and Optimize Your Setup

Once everything is functioning, fine-tune your replication rules. Adjust trade size logic, implement Follower Guard settings for safety, and enable features like ATM Copy for better exit handling. If you’re working across machines or VPS setups, explore Network Mode and Remote Mode for enhanced flexibility. For traders prioritizing discretion, Stealth Mode can help obscure metadata tied to copied trades.

By following these steps, you’ll have a powerful and scalable multi-account trading system fully integrated with NinjaTrader. Combined with a high-performance TradingVPS, you can ensure the fastest, most reliable copying performance possible—especially across brokers or geographically dispersed accounts.

How TradingVPS Fits Into This Automation

One final piece: if Replikanto and its features are the brain, you need the nervous system beneath it—and that’s TradingVPS. A high-performance VPS environment gives you:

- Low-latency routes to exchanges and brokers

- Dedicated CPU and memory resources to run Replikanto, NinjaTrader, and node components without contention

- High availability and minimal downtime, critical for automated systems

- Pre-tuned configuration for remote node communication, port rules, firewall settings

- Geographically distributed server options so your follower nodes can reside in optimal locations(Chicago, New York, London)

- Monitoring, backups, and support so that node failures or reboot events don’t break synchronization

With TradingVPS in place, your Replikanto-based automation stack runs smoother, with fewer surprises, and greater resilience.

Conclusion

As trading becomes faster, more fragmented, and increasingly automated, having a reliable, intelligent system isn’t just beneficial—it’s essential. Replikanto’s advanced features provide the backbone for that system. From real-time risk management with auto-disarm logic, to stealth protection that hides your trade copier footprint, to distributed trade execution with network and remote modes, and finally, to precise ATM Copy functionality that replicates exit strategies with surgical accuracy—each feature is built with a professional’s needs in mind.

Yet software is only as good as the environment it runs in. That’s why pairing Replikanto with a dedicated, performance-optimized infrastructure like TradingVPS is critical. With low-latency networking, dedicated resources, and robust availability, TradingVPS empowers your automated trading stack to operate at peak efficiency—whether you’re copying across 3 accounts or 30, across the same broker or multiple ones.

In a competitive landscape where microseconds can define profit or loss, and where order divergence or slippage can quietly erode results, having the right automation tools and infrastructure is not optional—it’s the edge.

Replikanto + TradingVPS isn’t just an integration—it’s your competitive advantage.