Introduction: Why Traders Are Moving to Automation

Manual trading can be stressful. Every click requires your attention, and even a small delay in order execution can cost money. Futures and options traders, in particular, need speed, accuracy, and discipline. That’s why more professionals are shifting to automated trading systems.

With the right setup, you can:

- Run your trading strategies 24/7

- Eliminate emotional decision-making

- Execute trades with ultra-low latency

- Scale across multiple brokers

In this guide, we’ll break down exactly how to automate Interactive Brokers (IBKR) trading using TradingView and PickMyTrade, while explaining why a TradingVPS is crucial for reliability.

What Is Automated Trading?

Automated trading means using software to execute trades based on predefined rules. Instead of manually buying or selling, you set conditions — such as price triggers, technical indicators, or strategies.

When those conditions are met, the system automatically places trades on your broker account. This removes delays, errors, and second-guessing.

For IBKR traders, this is now easier than ever with PickMyTrade, which acts as the bridge between your TradingView signals and Interactive Brokers orders.

Step 1: Connect Interactive Brokers to PickMyTrade

The first step is creating a live connection between IBKR and PickMyTrade.

Here’s how to set it up:

- Install Trader Workstation (TWS). Download and install TWS from Interactive Brokers. Log in with your IBKR credentials.

- Open PickMyTrade. From the dashboard, select IB Connection.

- Verify connection details. Ensure your token, account name, and settings are correct. Authorize the link. PickMyTrade connects to TWS using a secure API token.

Once connected, your TradingView alerts can flow directly into IBKR. Instead of worrying about complex APIs or coding, PickMyTrade handles everything in the background.

Step 2: Automate Your TradingView Strategies

Now that your account is linked, it’s time to automate trades.

Define Your Rules

Inside PickMyTrade, go to Generate Alert and set your parameters:

- Broker: Select IB (Interactive Brokers)

- Alert Type: Strategy (for full strategy automation) or Indicator (for specific signals)

- Instrument: Futures, Options, Stocks, or Futures Options

- Order Type: Market (MKT) or Limit (LMT).

👉 Tip: If you want to avoid “missed fills,” you can use features like Limit to Market Wait.

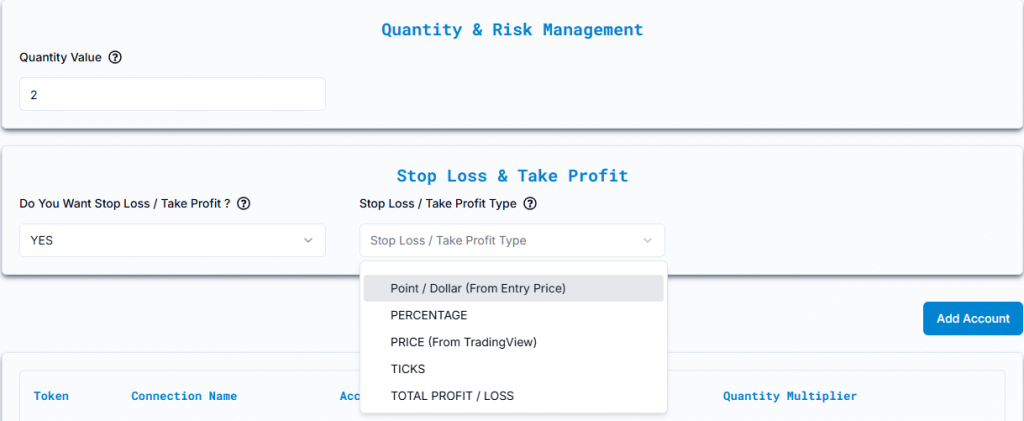

Add Risk Management

Good traders don’t just enter trades; they protect capital. With PickMyTrade, you can define:

- Stop Loss (SL) levels

- Take Profit (TP) targets

- Dollar-based, percentage-based, or tick-based risk controls

This ensures your account remains safe, even if markets move against you.

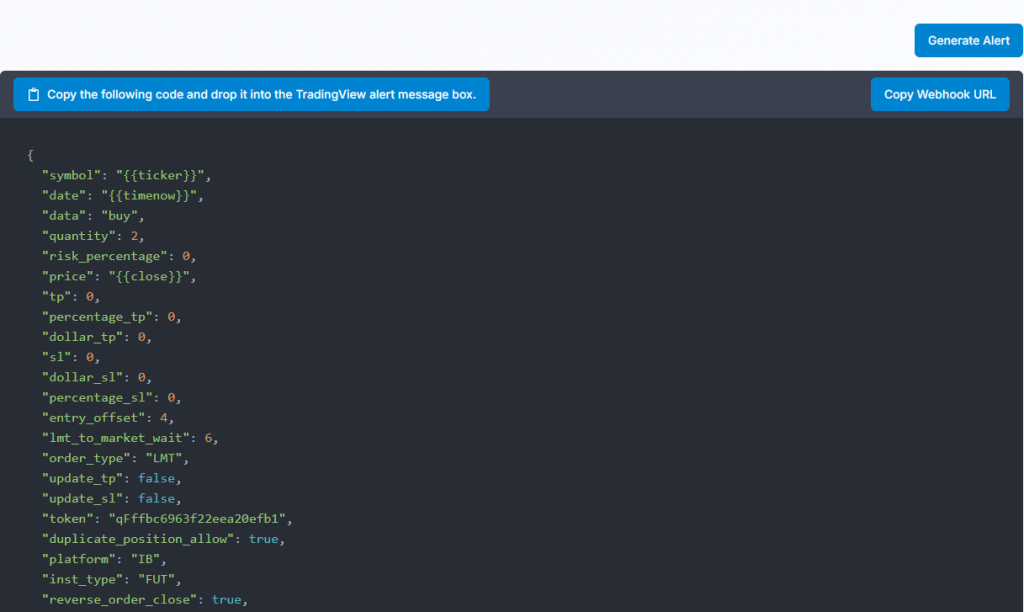

Generate the Alert Payload

After setting your rules, PickMyTrade generates a JSON payload — a small code that contains your trading instructions.

Set Up the TradingView Alert

- Go to your TradingView chart.

- Create an alert (Long Entry, Short Entry, etc.).

- Enable Webhook URL and paste the PickMyTrade link.

- Copy-paste the JSON payload into the message box.

Done! Every time your TradingView strategy triggers, PickMyTrade sends the order directly into IBKR.

Step 3: Automate Across Multiple Brokers

While this guide focuses on Interactive Brokers, PickMyTrade supports many platforms. That means you can automate your strategy once and run it across different brokers without rewriting code.

Supported brokers include:

- Interactive Brokers (IBKR): Deep market access with TWS API

- Tradovate: Modern futures platform

- TradeLocker: Forex-focused

- TradeStation: Advanced options and stock trading

- Rithmic: Low-latency futures execution

- TopstepX (ProjectX): For prop firm traders in the Trading Combine®

For traders managing multiple accounts or strategies, this multi-broker flexibility is a huge advantage.

Step 4: Why You Need a VPS for Reliable Automation

Here’s the truth: if you run automation on your home PC, you’ll face risks. Power outages, internet interruptions, or PC crashes can cause missed trades. Even a 5-minute disconnect can ruin a trading day.

Enter the Trading VPS

A Virtual Private Server (VPS) is a remote computer that runs 24/7 in a secure data center. Traders use VPS hosting to ensure their automation never stops.

Benefits of Using a Trading VPS

- Constant Uptime: Your setup runs even if your home internet or PC fails.

- Low Latency: VPS servers are hosted near financial exchanges like CME in Chicago, cutting order delays to milliseconds.

- Stability: Professional-grade infrastructure reduces lag and execution errors.

For traders, we recommend TradingVPS, built specifically for low-latency trading. We offer servers in Chicago, New York, and London, designed for futures and options markets.

Real-World Example: Futures Trading with VPS

Imagine you’re trading E-mini S&P futures through IBKR. Your strategy on TradingView signals a buy order at 4,500.

- Without a VPS: Your home PC freezes, and the trade isn’t placed. By the time you reconnect, the price is at 4,510 — you’ve missed the entry.

- With a VPS: The trade executes instantly, at the exact price your strategy intended. No delays. No missed profits.

This is why professional traders never rely on home setups for automation.

Final Thoughts: Trade Smarter, Not Harder

Automation is no longer just for hedge funds or algorithmic traders. With Interactive Brokers, TradingView, PickMyTrade, and TradingVPS, any trader can build a system that:

- Executes trades 24/7

- Protects capital with automated risk management

- Reduces latency with professional hosting

- Scales across multiple brokers

If you’re serious about trading, stop relying on manual clicks. Start building your automated trading system today and take advantage of the speed, reliability, and discipline that modern markets demand.

🚀 Ready to get started? Combine Interactive Brokers, PickMyTrade, and TradingVPS to unlock the future of trading.

FAQ: Automating Interactive Brokers Trading

Yes. PickMyTrade handles everything — no need for ib_insync, Python, or APIs.

TradingView makes it simple to create alerts and strategies, but you can also automate through other supported platforms.

Not mandatory, but strongly recommended. It ensures uptime, speed, and stability.

Stocks, Futures, Options, and Futures Options are all supported.

Yes. PickMyTrade lets you scale your strategy to multiple accounts and brokers at once.