Introduction

Prediction markets have entered a new era. In 2026, Polymarket trading bots are no longer experimental tools used only by developers or quantitative traders—they are now essential infrastructure for anyone serious about competing in prediction markets.

With Polymarket’s mature APIs, real-time WebSocket feeds, and modern programming libraries, traders can automate strategies that operate faster, more consistently, and with greater discipline than any human trader. A well-designed bot can monitor dozens of markets simultaneously, calculate probabilities in real time, and execute trades in milliseconds.

However, automation alone is not enough. Performance, uptime, and execution speed are directly tied to the infrastructure your bot runs on. That’s why professional traders deploy their bots on a dedicated Amsterdam Trading VPS powered by high performance CPUs, ensuring ultra-low latency, maximum stability, and uninterrupted 24/7 operation.

This guide walks you through everything—from understanding Polymarket mechanics to deploying a production-ready trading bot on enterprise-grade VPS infrastructure.

Understanding Polymarket and Prediction Markets in Depth

Polymarket is an on-chain prediction market platform where users trade outcome shares based on future events. These events span crypto markets, politics, economics, technology milestones, and real-world outcomes.

Most Polymarket markets use binary YES/NO structures, where prices range from $0.00 to $1.00. The price of a share directly represents the market’s implied probability.

For example:

- A YES share priced at $0.25 implies a 25% probability

- A YES share priced at $0.70 implies a 70% probability

If the event resolves as YES, the share settles at $1.00. If it resolves as NO, it settles at $0.00. This simple structure makes Polymarket ideal for algorithmic trading because probabilities, risk, and reward are clearly defined.

Polymarket uses a hybrid architecture:

- A fast off-chain Central Limit Order Book (CLOB) for order matching

- On-chain settlement on the Polygon network

- Stablecoin-based settlement for predictable P&L calculations

This combination of speed and transparency is what enables high-frequency automated trading strategies.

Why Polymarket Trading Bots Dominate in 2026

Manual trading struggles in modern prediction markets. Prices move quickly, opportunities appear and disappear in seconds, and multiple markets often react simultaneously to the same information.

Polymarket trading bots excel because they:

- Monitor markets continuously without fatigue

- React to price changes in milliseconds

- Eliminate emotional decision-making

- Enforce consistent risk management rules

- Scale across dozens of markets simultaneously

Bots can instantly exploit mispriced probabilities, arbitrage inefficiencies, and short-lived opportunities that humans simply cannot react to fast enough.

The Complete Architecture of a Polymarket Trading Bot

To build a reliable bot, it’s critical to understand its internal structure. Every professional Polymarket bot consists of three tightly integrated layers.

Data Collection Layer

This layer continuously gathers information from Polymarket:

- Active markets and metadata

- Live prices and probabilities

- Order book depth and liquidity changes

High-performance bots rely on WebSocket data streams instead of slow REST polling. This allows price updates to be processed in real time, often within milliseconds.

Strategy Layer (Decision Engine)

The strategy layer processes incoming data and determines when to trade. This is where logic lives.

Examples include:

- Detecting probability mispricing versus external data

- Identifying arbitrage when YES + NO prices deviate from $1.00

- Dynamically adjusting bids and asks for market making

This layer also calculates position sizing, monitors exposure, and ensures trades align with predefined risk parameters.

Execution Layer

Once a decision is made, the execution layer handles:

- Signing transactions

- Submitting orders to the Polymarket CLOB

- Managing open orders and filled positions

Execution speed is critical here. Even a few milliseconds of delay can turn a profitable trade into a missed opportunity.

Skills, Tools, and Requirements Before You Start

Before building your Polymarket trading bot, you should prepare the following:

- Working knowledge of Python or JavaScript

- Familiarity with APIs and WebSockets

- Understanding of basic blockchain concepts

- A secure crypto wallet

- Stable trading capital

- A professional Trading VPS

While development can begin locally, production trading should never run on a personal computer. Consumer hardware, sleep mode, power outages, and unstable internet connections create unacceptable risk.

Setting Up and Securing Your Crypto Wallet

Your wallet is the financial backbone of your trading bot.

Best practices include:

- Using a non-custodial wallet

- Separating development and production wallets

- Storing private keys only in encrypted environment variables

- Never committing credentials to code repositories

Ensure your wallet is funded with stablecoins on the Polygon network and properly approved to interact with Polymarket smart contracts.

Designing Robust Polymarket Trading Strategies

A trading bot is only as good as its strategy.

Common Polymarket bot strategies include:

- Mispricing detection: Buying outcomes priced below realistic probabilities

- Arbitrage: Exploiting inefficiencies across related markets

- Market making: Providing liquidity and earning spreads

- Event-driven trading: Reacting to news, polls, or data feeds

Professional traders start simple, validate performance, then gradually layer complexity as data and confidence grow.

Risk Management – The Difference Between Survival and Failure

Risk management is non-negotiable in automated trading.

Your bot should enforce:

- Maximum exposure per market

- Portfolio-wide risk limits

- Daily and weekly drawdown caps

- Liquidity and volatility filters

These protections must run continuously, which is only possible with reliable 24/7 infrastructure.

Why Infrastructure Matters More Than Strategy

Even the best strategy will fail on weak infrastructure.

A Polymarket trading bot requires:

- Constant uptime

- Ultra-low latency

- High single-core and multi-core CPU performance

- Stable network connectivity

This is exactly where a dedicated Amsterdam Trading VPS powered by high performance CPU becomes a competitive advantage.

Our Amsterdam Trading VPS – Built for Polymarket Bots

Our TradingVPS solutions are purpose-built for automated trading and prediction market bots.

Key advantages include:

- Ryzen 9 9950X CPUs for extreme single-core and multi-thread performance

- Ultra-low latency connectivity ideal for Polymarket APIs and WebSockets

- 24/7 uptime with enterprise-grade stability

- Dedicated resources—no noisy neighbors

- Secure environment optimized for long-running trading processes

The Ryzen 9 9950X delivers exceptional performance for real-time data processing, strategy evaluation, and rapid order execution—exactly what high-frequency Polymarket bots demand.

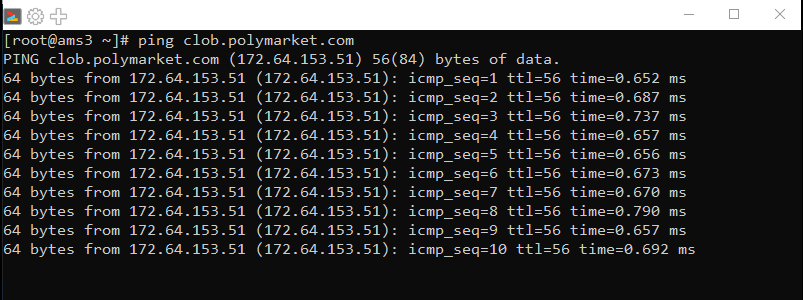

Real-World Latency Test (Amsterdam VPS → Polymarket)

To validate real trading performance, we tested network latency from our Amsterdam Trading VPS to Polymarket infrastructure.

Average ping result: ~0.6–0.8 ms

This ultra-low latency allows trading bots to receive order book updates and execute trades almost instantly. In prediction markets, where arbitrage windows can last only seconds, even small delays can mean missed opportunities or worse fills.

Compared to home internet connections—which often experience fluctuating latency, packet loss, and interruptions—our Amsterdam Trading VPS provides consistent, stable, and predictable execution performance for Polymarket bots.

Deploying Your Polymarket Bot on an Amsterdam Trading VPS

Once your strategy is tested locally, deployment is straightforward:

- Upload your bot to the VPS

- Install dependencies and runtime

- Configure environment variables securely

- Set up process management for continuous execution

With your bot running on our Amsterdam Trading VPS, it operates 24/7 without interruption, even during volatile market conditions.

Monitoring, Optimization, and Scaling

After deployment, continuous monitoring is essential.

Track:

- Execution speed

- Slippage

- Win rate

- Drawdowns

As performance improves, you can scale across multiple markets, deploy multiple strategies, or increase capital—confident that your VPS infrastructure can handle the load.

Common Mistakes to Avoid

Many traders fail due to preventable errors:

- Running bots on personal machines

- Underestimating latency impact

- Ignoring liquidity constraints

- Scaling too aggressively

Professional infrastructure eliminates many of these risks.

Conclusion

Polymarket trading bots represent the future of prediction market trading. They enable speed, consistency, and scalability that manual trading cannot match.

However, true success requires more than just good code. By deploying your bot on our Amsterdam Trading VPS powered by Ryzen 9 9950X CPUs, you gain the infrastructure advantage needed to compete at the highest level.

If you’re serious about automating Polymarket trading in 2026, start with the right strategy—and the right VPS foundation.