Introduction

In the world of active trading, especially with futures and proprietary firm accounts, efficiency, reliability, and synchronization across multiple accounts are critical. The ability to manage trades consistently across different platforms, brokers, and account sizes can give traders a significant edge—not just in execution speed, but in maintaining consistency and control over diverse trading setups.

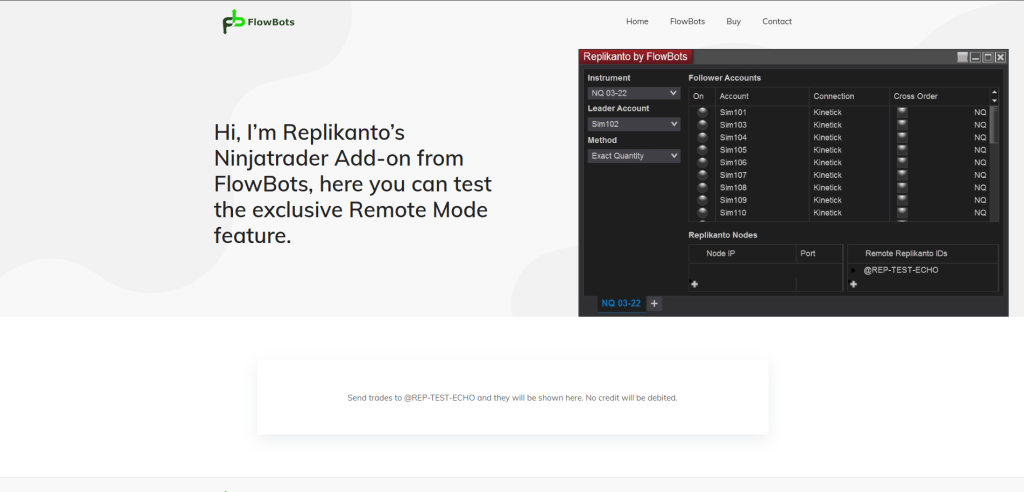

That’s where Replikanto steps in. Built as a powerful trade copier add‑on for NinjaTrader 8, Replikanto allows traders to replicate trades in real time across multiple accounts, whether they are hosted locally on a single machine or remotely across several VPS environments. It’s not just a trade duplicator—it’s a sophisticated synchronization tool designed to handle the complexity of modern trading infrastructure, including copy trading with prop firms, signal broadcasting, or managing diversified client accounts.

With support for advanced features like cross-broker compatibility, customizable copy modes, and latency optimization tools, Replikanto helps traders reduce manual repetition, prevent order mismatches, and improve risk management across the board. And when paired with the right infrastructure—like our high-performance TradingVPS—it transforms from a convenient tool into a mission-critical solution that enhances performance, reliability, and scalability.

In this blog, we’ll explore how Replikanto integrates with NinjaTrader to support:

- Multi-account trading

- Cross-broker compatibility

- Latency optimization and real‑time copying

What Is Replikanto?

Replikanto is a trade copier (or order replicator) add-on for NinjaTrader 8, developed by FlowBots. It allows a “leader” account to send trades (entries, exits, adjustments) to one or more “follower” accounts based on configurable copy logic.

Some of its notable features include:

- ATM Copy — instead of copying exit orders, it can instruct followers to run their own NinjaTrader ATM strategies for exits, improving speed and flexibility.

- Cross Order — ability to map between contract types (e.g. micro ⇄ mini) for cross‑instrument copying.

- Market Only mode — only copy market executions, skipping non‑market orders to reduce noise.

- Follower Guard — safety rules to automatically disable copy to a follower under certain error or divergence conditions.

- Remote / Network mode — operate across machines (VPSs or computers) over LAN or Internet.

- Stealth Mode — obfuscates the use of copy trading in the order metadata to reduce detection.

Because of these capabilities, Replikanto is widely used in prop firm setups, signal distribution, and multi-account strategies.

Multi-Account Trading That Scales With Confidence

Once Replikanto is installed inside NinjaTrader, managing multiple accounts becomes significantly easier. Traders can define one master or “leader” account, place a trade, and have it automatically duplicated across all “follower” accounts. These accounts can belong to different brokers, prop firms, or funding programs, making this especially valuable for those managing multiple evaluation or live funded accounts.

Users have the flexibility to choose how trades are allocated across followers — whether it’s matching the exact quantity of the leader, distributing based on account size, or even custom ratios. This ensures that each account reflects the appropriate exposure based on its individual capital or trading rules.

What makes Replikanto stand out is its ability to avoid slippage or overexposure through built-in risk controls. For instance, if an error occurs on a follower account or its orders are rejected due to margin constraints, Replikanto can disable that account temporarily using its Follower Guard feature. This way, the system remains clean and in sync, avoiding cascading issues across other accounts.

Cross-Broker Compatibility Without Compromise

One of Replikanto’s biggest strengths is its seamless handling of cross-broker executions. Different brokers often have distinct symbol formats, contract types, and routing systems, which traditionally made cross-platform copying difficult. Replikanto solves this by allowing traders to map instruments between the leader and each follower — for instance, translating an ES trade into a MES or even into a different contract class entirely.

This makes it ideal for traders using a mix of NinjaTrader-connected brokers or platforms like Rithmic, Tradovate, and others. Whether your accounts are hosted at the same broker or scattered across different firms, Replikanto maintains consistency in execution through customizable symbol mapping and order logic translation.

Of course, while Replikanto handles the logic, the success of cross-broker copying also depends heavily on execution speed and infrastructure — especially when order types and fills can vary slightly between platforms.

Latency Optimization & Real-Time Copying

Speed is everything in modern trading. The ability to execute trades across multiple accounts in real-time can mean the difference between hitting a target and suffering slippage. Replikanto is designed to minimize latency at every step, offering traders near-instantaneous trade replication when configured correctly.

Local copying (on the same machine) is typically the fastest, often completing in milliseconds. Remote copying, on the other hand, involves sending order instructions over a network. While Replikanto is optimized for this too, remote setups are more sensitive to internet speed, hardware capacity, and geographic distance between servers.

To ensure accurate, real-time copying, traders often use Market Only mode, which avoids the delay of handling complex order types. The ATM Copy feature also helps maintain execution speed by letting each follower manage its own exits, reducing network dependency.

Yet, even with advanced software logic, latency issues can still emerge if the system is run on underpowered hardware or slow internet. That’s why a proper infrastructure setup is critical.

How to Set Up and Use Replikanto with NinjaTrader

Setting up Replikanto with NinjaTrader 8 is straightforward, but attention to detail is key to ensuring reliable trade replication. Below is a step-by-step walkthrough to help you install, configure, and optimize Replikanto for seamless multi-account and cross-broker trading.

Step 1: Register and Download Replikanto

Begin by visiting the official Replikanto website. After creating your account, download the Replikanto software package, which comes as a NinjaScript add-on compatible with NinjaTrader 8. Be sure to save the file in an accessible location on your computer.

Step 2: Install Replikanto into NinjaTrader 8

Open NinjaTrader 8 and go to the Control Center. From the top menu, click Tools → Import → NinjaScript Add-On, and select the Replikanto file you downloaded. Once the installation completes, restart NinjaTrader to apply the changes and load the add-on successfully.

Step 3: Connect Your Trading Account

Before Replikanto can replicate trades, your trading account must be connected through NinjaTrader. Use the Connections menu to establish a secure link with your broker. Once connected, authorize Replikanto to access and manage your trading activity within the platform.

Step 4: Configure Your Leader and Follower Accounts

Now it’s time to define your Leader account (where you’ll initiate trades) and your Follower accounts (which will mirror the trades). Navigate to Tools → Replikanto Settings. Input the relevant account IDs and choose your preferred replication method — options include Exact Quantity, Ratio-Based, Net Liquidation, and more. This configuration determines how trades are distributed across follower accounts.

Step 5: Run a Test Copy Trade

Before going live, it’s crucial to validate that everything is working as expected. Execute a small test trade on your Leader account and monitor the Follower accounts in real time. Replikanto provides visual tools and logs that help confirm synchronization and spot any errors.

Step 6: Customize and Optimize Your Setup

Once everything is functioning, fine-tune your replication rules. Adjust trade size logic, implement Follower Guard settings for safety, and enable features like ATM Copy for better exit handling. If you’re working across machines or VPS setups, explore Network Mode and Remote Mode for enhanced flexibility. For traders prioritizing discretion, Stealth Mode can help obscure metadata tied to copied trades.

By following these steps, you’ll have a powerful and scalable multi-account trading system fully integrated with NinjaTrader. Combined with a high-performance TradingVPS, you can ensure the fastest, most reliable copying performance possible—especially across brokers or geographically dispersed accounts.

The Role of TradingVPS: Boosting Replikanto Performance

Running Replikanto and NinjaTrader on a high-performance machine is essential — and this is where TradingVPS comes in. A standard home PC or office network often can’t provide the uptime, speed, and network reliability that high-frequency trading demands. Our TradingVPS is specifically built to support tools like Replikanto.

Here’s how TradingVPS strengthens your trading workflow:

- Low Latency Network Access: Our servers are strategically located close to key exchange data centers and popular broker infrastructures, minimizing the distance between your VPS and the execution engine. This dramatically reduces round-trip order times.

- Stable and Isolated Environment: Unlike shared hosting, our VPS instances guarantee dedicated CPU and memory resources. This ensures NinjaTrader and Replikanto run smoothly without competition from other applications or users.

- High Uptime with Pro Monitoring: Trading requires 24/7 availability, especially for multi-account strategies. Our VPS includes automated monitoring, high uptime SLAs, and fast support response times to minimize downtime risk.

- Pre-Optimized Configuration for NinjaTrader & Replikanto: You don’t have to worry about setup — our environment is configured to handle remote copying, firewall rules, port forwarding, and system tuning out of the box.

By leveraging TradingVPS, you’re not just accelerating order copying — you’re also adding a layer of operational resilience and technical consistency. It becomes the backbone of your trading system, ensuring Replikanto performs to its full potential.

Final Thoughts

Replikanto’s deep integration with NinjaTrader provides a robust foundation for multi-account, real-time, cross-broker trading. Its flexibility in copy logic, safety mechanisms, and symbol translation make it a trusted tool among retail and prop firm traders alike.

But to truly unlock its power, traders must pair it with the right infrastructure. That’s why our TradingVPS service is the ideal companion — enabling lightning-fast execution, stable system performance, and secure remote operations across all accounts.

If you’re ready to streamline your trading with high-performance tools that scale, it’s time to combine Replikanto with our optimized VPS solutions.